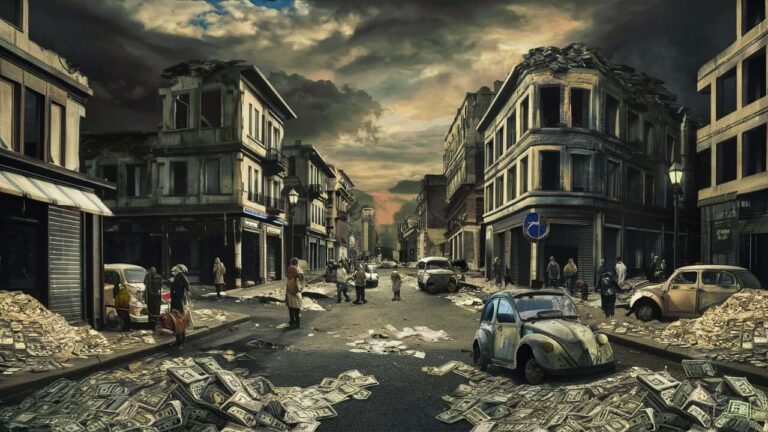

Crypto Trap: Balancing the Promise and Peril of Cryptocurrencies

Cryptocurrencies have revolutionized the financial landscape, promising a future where financial transactions are decentralized, secure, and free from the constraints of traditional banking systems. While the potential benefits of cryptocurrencies are undeniable, it is equally important to recognize the inherent risks associated with this burgeoning asset class. In this article, we explore the dual nature of cryptocurrencies: their role in decentralization and the significant caution needed due to their lack of transparency and regulation.